What’s the best payment gateway for dropshipping?

Stripe is considered one of the best payment gateway options for dropshipping because of its ease of use and flexibility. Stripe allows for quick and easy integration with e-commerce platforms such as Shopify and BigCommerce, making it simple for dropshippers to set up their online store and start accepting payments. Additionally, Stripe supports a wide range of payment methods, including credit and debit cards, Apple Pay, and Google Pay, which allows for a seamless checkout experience for customers. Stripe also offers advanced features such as fraud detection, recurring payments, and the ability to create custom checkout pages. Overall, Stripe's user-friendly interface, broad range of payment options, and advanced features make it an ideal choice for dropshippers looking for a reliable and flexible payment gateway.

In an increasingly digitally-driven marketplace, eCommerce and dropshipping are ever on the rise. Likewise, the technology to improve and facilitate growing online sales is changing rapidly, and companies are left alone to sift through endless options and third-party platforms. Retailers are already stretched thin with day-to-day management, so the process of maximizing the potential of your online sales can be daunting.

We get it, and we’re here to help.

Whether you’re a Fortune 500 company or a local mom-and-pop shop, the question remains the same: how can you find and integrate the right technology into your business model to drive sales and expand your position in the marketplace?

While there are many additive marketing and sales tools for online businesses, one of the core components of any online operation is payment gateways. We understand that getting down and dirty with payment systems is not for the faint of heart, so we’ve sifted through some of the best gateway options for you and your business.

What is a Payment Gateway?

A payment gateway is essentially the tool that facilitates any online transaction between your business and your customers. Selling goods or services is only possible with a payment gateway in place. Payment systems range in complexity, but both e-commerce and dropship stores rely on them to be financially viable operations. Indeed, dropship stores need a payment platform to complete transactions to sell goods from manufacturers as much as e-commerce platforms need payment gateways to complete online transactions.

Payment systems connect a brand with customers and dictates much of the user experience. How they operate, their ease of use, and features for both you and consumers all have tangible impacts on sales, revenue, and customer engagement.

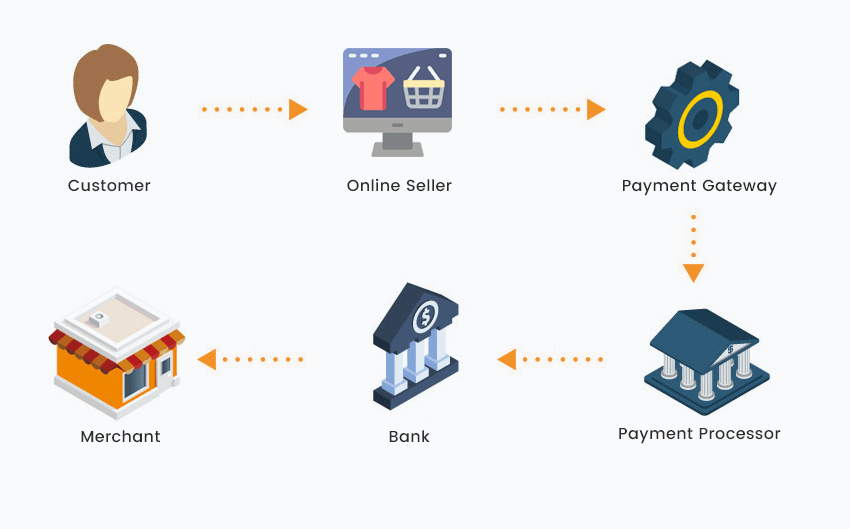

How do eCommerce Payment Gateways work?

All payment gateways are designed to enable safe, secure, and simple online purchases for both the merchant and consumer. There are two broad categories to know when selecting your payment gateway: integrated versus hosted payment systems. Integrated gateways redirect customers to the payment platform’s processor to finish their online purchases. In contrast, integrated gateways allow you to connect your website through the payment gateway’s API (Application Programming Interface) so that your customer does not leave your domain. Redirecting to a third-party platform is a notorious disruption of sales, so that’s something to consider when selecting a payment platforms.

Secondly, all payment gateways are PCI compliant, meaning that they meet specific security standards as they collect sensitive information like credit card numbers and addresses.

The process is this: a payment gateway’s role begins as a customer starts the checkout process on your eCommerce or dropship store. Once a customer fills in their credit card information, the gateway sends encoded transaction data to the payment processor of the seller’s bank.

The payment processor then sends that data to the associated credit card, and the credit card’s bank approves or denies the transaction request. The processor delivers the approval back to the gateway, and then the payment system successfully and securely processes said payment. Finally, the pending purchase clears as soon as the seller fulfills the customer’s order, and the seller’s bank can receive the payment from the customer’s bank.

Even though the name for them sounds a bit strange and scary, payment gateways operate in a pretty straightforward way. Choosing a payment platform, though, can be a much murkier process.

Best Payment Gateways for Dropshipping & Ecommerce

Given that every business and brand has unique needs, constraints, and market goals, the list of gateways below is not a ranking of best to worst. Instead, it is a comprehensive list of the most useful available payment gateways that will ensure quality, no matter which solution is right for your venture. For an efficient and user-friendly experience, consider payment gateway dashboard to manage and optimize your payment processes seamlessly. Here’s a general breakdown of the fees, with analysis to follow.

| Payment Gateway | Fees | ||

|---|---|---|---|

| Fixed Monthly fees | Per Transaction fees | ||

| Flat $ transaction fee | Percentage transaction fee | ||

| PayPal (PayPal Calculator) | $0 | $0.30 | 2.9% |

| Stripe | $0 | $0.30 | 2.9% |

| Adyen | $0 | $0.12 | varies |

| 2Checkout | $0 | $0.30 | 3.5% |

| Vapulus | $0 | $0.00 | 0.0% |

| PaySimple | $49.95 | n/a | 2.49% |

| Dwolla | $0 | $0.01 - $5.00 | 5.0% |

| Square | $0 | $0.30 | 2.9% |

| Payoneer | $0 | $3.00 | 0.0% |

| CardinalCommerce | n/a | n/a | n/a |

| Skrill | $0 | $0.29 | 2.6% - 2.9% |

| authorize.net | $25 | $0.30 | 2.9% |

| WePay | $0 | $0.30 | 2.9% |

| BlueSnap | $0 | $0.30 | 3.9% |

| Braintree | $0 | $0.30 | 2.9% |

| Amazon Payments | $0 | $0.30 | 2.9% |

| Payline | $20 | $0.20 | 3.0% |

Here are some of the best payment gateway names in the game:

1. PayPal

PayPal is, perhaps, the biggest beast in the payment gateway jungle.

Indeed, Paypal is a giant payment gateway, which works as an advantage for vendors. It holds the promise of familiarity and trust among consumers; this is particularly important for small brands and companies that do not yet have widespread brand recognition and trust. Its name brand recognition will likely result in higher conversion rates. A whopping 305 million people use PayPal, and it is accepted in over 200 countries worldwide in 25 different currencies. It’s a tried-and-true gateway that is ideal for many types of e-commerce and dropshipping operations. PayPal also supports all major credit cards as well as debit cards, PayPal, Venmo, PayPal credit, and some custom business debit cards.

It is worth noting PayPal has other options available to vendors including PayPal Payments Pro (a gateway option that doesn’t require purchasers to have a PayPal account), PayPal Payments Standard (a version of PayPal Payments Pro), and PayPal Express Checkout (allows users to purchase by using just their PayPal credentials).

PayPal is also widely used and available for integration for the majority of the e-commerce platforms in the market, such as:

2. Stripe

Call your tech department before choosing Stripe and, if you don’t have one, think about hiring one.

Another popular, global payment gateway is Stripe, which has fantastic customer support for vendors and increased flexibility in the form of more extensive developer tools. With a flexible API, you can customize the platform to your needs. An excellent choice for businesses with developers and tech specialists on hand, you can add a Stripe POS system to your brick-and-mortar store, bill your customers regularly and routinely, and complete one-time payments - whatever your business needs.

Vendors who choose to use Stripe also have the benefit of its many partnerships with the exceptionally high number of third-party platforms and tools that may improve your website experience.

3. Adyen

eBay moved its massive operation to Adyen back in 2018, and the payment gateway has only grown since then. Adyen accepts over 250 payment methods and 150 currencies from around the world and provides its users with in-depth customer analytics and insights. Its advantages speak for itself: conduct business efficiently and globally and use the detailed data to modify listings according to consumer behavior in real-time. Then, just watch your sales increase. The gateway is also designed to look out for vendors. There are integrated risk-management features that search and fight fraud. One of the only downsides? Its pricing model can get complicated, and that can be frustrating for vendors.

4. 2Checkout

The U.S. based payment system brings two major critical cards to the table: excellent localization and the ability to integrate with other systems easily. 2Checkout simplifies transactions for customers by supporting different languages and currencies and accepting online and mobile payments. You cannot overestimate the value of simple, easy-to-use interfaces for consumers. In the same spirit of streamlining the eCommerce process, 2Checkout can combine with online shopping carts and invoicing systems to help you process your payments faster and easier.

In other words, 2Checkout will help you stay sane as much as it will grow your sales.

5. Vapulus

Everyone loves free stuff, even in the niche world of payment gateways. That’s one of the many reasons why we love Vapulus.

Vapulus is grounded in simplifying mobile payments, which is a considerable asset in a world of rising mobile shoppers. While it is a global platform, what sets Vapulus apart from the crowd is its commitment to charge vendors 0% fee, giving you 100% of your sales. Given its nonexistent fees and unique ability to send targeted customer perks and discounts, it is a fantastic option for small businesses. It will assist small brands in developing a loyal customer base and expanding their market presence domestically and internationally. It is a formidable competitor in terms of giving vendors a single interface with plenty of data that is easily analyzed.

6. PaySimple

The name says it all.

PaySimple is an incredibly functional platform that prioritizes product placement and marketing services to drive traffic and conversions via your website and social media. It boasts of endless flexibility with the ability to accept credit card and e-check payments across all sales avenues, including in person with a POS system, on the phone, and online. You can also utilize PaySimple’s sales and order data to generate standard and customized reports that will give you invaluable customer insights.

7. Dwolla

Dwolla might not be the right choice for traditional, product-based retail businesses, but it is a lifesaver gateway for businesses that rely on bank transfers to conduct sales. Dwolla is a scalable, flexible platform that works well with all United States banks and financial institutions. Much like Stripe, it is open-source software that permits developers to integrate bank transfers whatever company-specific tools needed.

8. Square

Square has gained more name brand recognition through high profile e-commerce partnerships with organizations like Wix, WooCommerce, WordPress, OpenCart, Magneto, and Ecwid. Known for its POS systems intended for brick-and-mortar locations and in-person payments, Square has expanded its gateway payment capabilities and become more and more of an asset for business owners. If part of your longterm business model includes plans for physical store locations, Square is a good investment in the future.

9. Payoneer

Payoneer empowers freelancers and small businesses to stake a claim in international markets. It offers an unparalleled mass payout system that makes the global workforce a much tighter, stronger, and more communicative network. Companies can hire and quickly pay contractors and freelancers from all over the world, regardless of where they operate. Payoneer enhances its payout platform by supporting over 35 languages, which makes the localization process a breeze.

10. CardinalCommerce

As a business owner, you don’t always find too many people willing to hold your hand, and sometimes that’s just what you need. If you’re feeling like you could use some extra support and guidance on the gateway front, let us introduce you to your new best friend.

CardinalCommerce nurtures entrepreneurs and startups in a way that is unlike any of its competitors. They have targeted and prioritized the needs of those new to business and commerce, and created tools and support systems to help entrepreneurs navigate the complex startup world. Find advice on blogging, shipping, and marketing, as well as individual attention from experts who can give you some financial guidance tailored to your business. Even for those who are not novices or newbies in the e-commerce jungle, CardinalCommerce offers exceptional fraud protection.

11. Skrill

What Skrill lacks in vowels, it makes up for in flexibility and easy mobile app use.

Skrill is a newer payment gateway that has claimed a significant portion of the gateway market with its focus on low-cost international money transfers that allow you to pay for things all over the world. Its success is rooted in its ability to accommodate all scales of business, from individuals to massive companies. Additionally, it has a mobile app that supports payments and an official extension for integration with WooCommerce-based dropshipping stores.

12. authorize.net

Don’t be scared off by its name. While authorize.net doesn’t exactly have the flashiest branding, it is packed with superb quality.

One of the oldest and most proven payment system platforms available, authorize.net is a product of Visa that began back in 1996. It has less name-brand recognition than PayPal, but a long history of successful relationships with small to medium businesses, and a significant portion of their demographic operating in the United States. authorize.net has the duality of working online and in-person and gives its vendors the ability to tokenize sensitive customer information. A major plus? Their website offers exceptional customer service to merchants as well as hugely helpful blogs, how-tos, and support for the integration and customization process. They have a variety of plans with different pricing and features, including their All-in-One plan for those without a merchant account and Enterprise Solutions plan, for large companies.

13. WePay

As a product of Chase, WePay strives to curate the optimal payment experience. It’s a fairly complex system that gives companies the flexibility they need to adapt their operations to their changing objectives. Because of its complexity, WePay comes with the benefit of extensive support as well as 100% payment risk coverage. It facilitates both online and in-person sales with its POS solution, which makes it an attractive option for retailers who operate in both worlds.

14. BlueSnap

BlueSnap operates in 100 currencies, 29 different languages, 110 payment types, and 180 countries, making it a truly global and multifaceted option for your brand. It communicates with a worldwide network of banks to get the best conversion rates for users and is distinct in its ability to let developers create desktop and mobile applications. BlueSnap’s cross-functionality is both unmatched and an irreplaceable feature for those with the tech abilities to capitalize on it. It also integrates seamlessly with Visa, MasterCard, Discover, Apple Pay, and PayPal.

15. Braintree

Braintree is a longtime partner of PayPal with a global reach spanning over 40 countries and 130 currencies. Braintree’s payment gateway has concentrated its efforts on maintaining an effortless checkout process in the face of shifting technologies and marketplaces. It has been a worthwhile investment, as customer retention rates of their clients are famously steady. A key part of this retention is because of Braintree’s checkout flow customization abilities; vendors can modify checkouts to strengthen their branded shopping experience while keeping customer information secure.

Its pricing is structured as four distinct modules to accommodate all kinds of businesses and operations, which helps business owners pay for the features they need, not just as many features as they can buy.

16. Amazon Payments

Amazon is always in the business of making the digital marketplace more streamlined and user-friendly, and their payment platform is no different. Amazon Payments gateway consists of two components: Pay With Amazon for vendors and Login and Pay for consumers. The system allows users to checkout via their Amazon credentials on both online and mobile platforms and focuses its efforts on helping businesses develop loyal customer bases. While Amazon is newer to the gateway game than someone like PayPal, the ease and worldwide dependence on Amazon carries significant weight among consumers that will benefit your sales.

17. Payline

If you often want to throw your computer out the window in frustration, then this probably isn’t the right choice for you.

Payline’s payment gateway is conducive to credit card-driven sales, but it demands much more of its users (you) than other gateway available. Be prepared to invest a little bit more time getting Payline fully integrated with your existing operations. What Payline lacks in a speedy initial startup time, though, it makes up for in its flexible and transparent month-to-month contracts and interchange-plus pricing. With its competitive pricing and simple user interface, Payline is designed to handle high-risk businesses and high volume vendors.

A Note on Fees:

With the exception of Vapulus, all payment systems have either transactional fees or monthly subscription fees (or both). While the pricing is scaled to the level of integration, support, and services you need, a fairly standard fee is 2.9% + $0.30 per domestic transaction, with some variation dependent on the gateway’s area of expertise.

How to Choose the Best Payment Methods for your Online Store:

The most important thing to remember when selecting a payment gateway for your eCommerce or drop shipping platform is that there isn’t a one-size-fits-all solution. Consider all facets of your operations, short-term and long-term goals, and current weaknesses that your payment system might be able to improve.

Ask yourself many questions during the selection process:

- Can a payment gateway grow and evolve as your business does? Are you planning on expanding into new markets? If so, prioritize a payment platform that excels at localizing transactions for international customers.

- Is there ample customer support for you as a vendor? Business owners must get the help they need so that their technology works with them, not against them.

- How much does it cost, and how are the payments structured? For larger businesses, smaller monthly subscription fees are more financially viable than more substantial transactional fees, whereas the opposite is true for individuals and small businesses.

- Who owns your customers’ data, and how secure is your payment gateway? Security, trust, and transparency mean everything to consumers.

- How widely used and understood is the payment system in your core market? Tailor your eCommerce and drop shipping experience to your loyal customer base first, and expand into new markets second.

- Does your platform work well with your payment system of choice? Not all eCommerce platforms accept all payment gateways. Verify that your gateway of choice is compatible with your eCommerce or drop shipping platform.

Part of figuring out the most logical and seamless solution for your business means considering a combination of several payment platform providers and being open to some experimentation, particularly with dropshipping. Many of the gateways here will combine beautifully with each other as well as with digital wallets like Apple Pay, Google Pay, and Android Pay.

With much of the world toting iPhones around and talking into their Apple watches, looking into Apple Pay as an integration or your e-commerce or dropship platform makes financial sense if you think a combination of integrations is the right route for your business. Much like Amazon, Apple’s reputation for simplicity and solid design precedes it, and billions of people already have Apple accounts and money sitting in their Apple Pay.

Whew, you’ve made it. Congrats! You’ve got a lot to consider, but just remember that there’s plenty of room for experimentation. Don’t be afraid to try a certain gateway solution and then pivot if it isn’t serving your business well. You know your business better than anyone else does.

While it can be overwhelming, there’s never been a better time to be in eCommerce or dropshipping. The resources and technologies emerging in the business landscape right now reflect the 21st-century consumer priorities; they recognize the importance of an intuitive, localized customer buying experience and the rising dependence on mobile-based shopping. With some experimentation, analytics, and a solid understanding of your company framework, you’ll be able to harness today’s technologies into an individualized payment system solution that will improve your sales numbers and customer engagement.